[ad_1]

The lockdowns of 2020 might have prompted shoppers to set additional money toward their surroundings, boosting income for home enhancement stores Lowe’s (NYSE:Lower) and Residence Depot (NYSE:Hd), but the financial and housing availability crunches of 2022 are holding them there.

Household furniture, electronics and home office established-ups aimed at generating home a greater position to stay and do the job fueled 2020 getting, but with shoppers struggling with climbing expenditures of fuel and food items, theyre going to property advancement stores to tackle repairs by themselves and start out gardens. This is trying to keep growth at Lowe’s and Residence Depot powerful, generating them the two likely profitable portfolio additions this summer, in my belief.

The two selections have soaring dividend yields, building them eye-catching for benefit buyers on the lookout to make passive revenue as effectively. Right before you insert possibly of these residence advancement shares to your portfolio, while, there are some disadvantages to consider.

Lowes

Lowes (NYSE:Minimal) is a residence advancement retail chain working in the U.S., Canada and Mexico. It delivers goods for construction, routine maintenance, repairs and reworking. The housing current market may possibly be cooling a small from the highs of 2021, which may perhaps encourage tasks in the dwelling youre in.

Revenues for the enterprise have doubled in excess of the past 10 years, and earnings for every share are predicted to increase all-around 13%. Lowe’s has a dividend yield of 1.66%, and the company has a long keep track of document of soaring dividends. That could assist sweeten the offer for traders.

Analysts fee Lowe’s a get, even although bulls think the organization faces threats from increasing fascination rates, offer chain issues and flattening housing rates. Its well worth noting that the median age of residences in the U.S. is 39 decades, an age when properties will need to have an escalating amount of money of upkeep and could be candidates for remodeling.

Lowe’s receives a GF Rating of 96, driven principally by top scores for profiability and growth.

Household Depot

Surpassing forecasts in 9 of the final 10 quarters, a further key U.S. property enhancement retailer, Home Depot (NYSE:Hd), not too long ago claimed 10.7% progress in internet product sales 12 months-above-yr.

House Depot counts skilled contractors among its greatest clients, and their major-ticket purchases had been up 18% all through the previous calendar year. EPS has developed 17% more than the earlier 3 years and income is up 8% around the earlier year, receiving it a obtain score from analysts.

Property Depot has a dividend yield of 2.26%, generating it the more eye-catching of these two stocks for all those in look for of dividends.

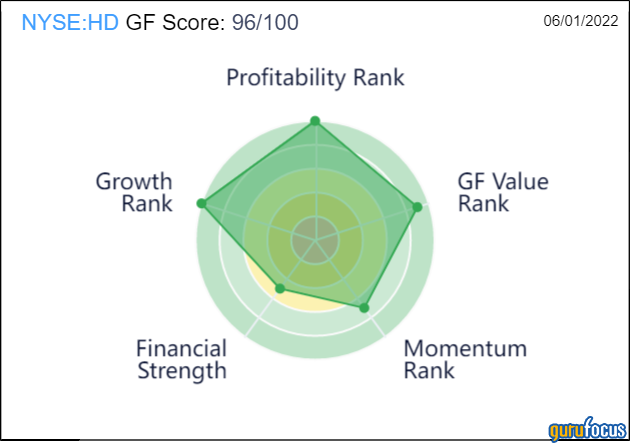

Like Lowe’s, House Depot also has a GF Score of of 96/100. In addition to large expansion and profitability, it scores superior than Lowe’s for GF Value, nevertheless it loses factors for weaker momentum.

This short article first appeared on GuruFocus.

[ad_2]

Source connection