Helix Energy Solutions: Buy Ahead Of Major Earnings Improvement (NYSE:HLX)

[ad_1]

Sergei Dubrovskii

Houston-primarily based Helix Vitality Solutions Team, Inc. (NYSE:HLX), or “Helix,” is 1 of the world’s primary offshore vitality specialty products and services firms.

The company operates via 3 segments: Nicely Intervention, Robotics, and Output Services, with the perfectly intervention organization presently contributing close to two thirds of revenues.

Helix not too long ago obtained the Alliance team of providers (“Alliance”) for $120 million in dollars, a Louisiana-primarily based service provider of providers in guidance of the upstream and midstream industries in the Gulf of Mexico shelf, such as offshore oil industry decommissioning and reclamation, undertaking management, engineered answers, intervention, maintenance, maintenance, hefty raise and professional diving companies.

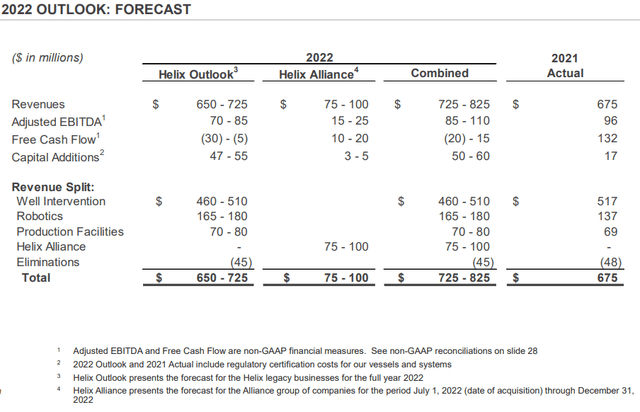

The acquisition will contribute Modified EBITDA of up to $25 million and increase consolidated income by about 15% this 12 months.

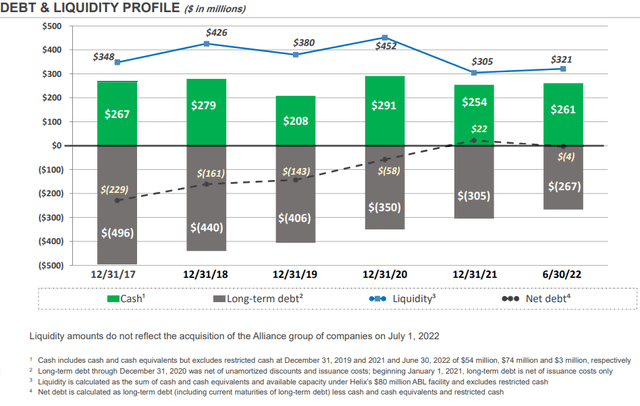

Helix has carried out really effectively for most of the industry downturn as monetary effects were boosted by a amount of high-margin legacy contracts. As a final result, the enterprise has not only managed to continue to be afloat but also reduced debt significantly in recent many years:

Company Presentation

Make sure you note that the a short while ago concluded Alliance acquisition will cut down hard cash on hand by $120 million future quarter.

That explained, administration expects 2022 to be a changeover calendar year with various vessels undergoing regulatory inspections, a sluggish return for the North Sea industry and a selection of models performing quick-term perform at decreased costs with the firm’s two contemporary effectively intervention vessels in Brazil producing an approximated $35 million EBITDA strike on your own.

As a consequence, the put together company’s free of charge dollars move will only be all over break-even amounts, down from $132 million recorded last calendar year:

Company Presentation

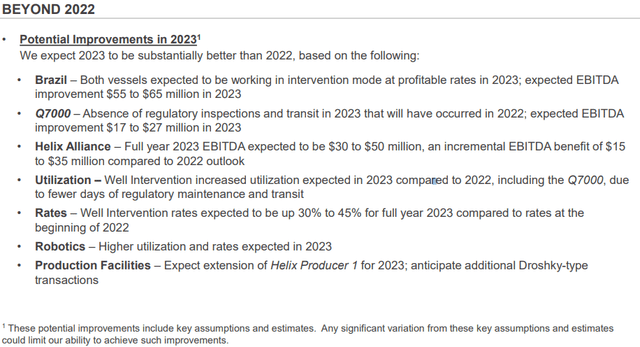

But issues are envisioned to improve for the much better likely into the second fifty percent and subsequent calendar year as enterprise conditions are bettering throughout all segments as stated by administration on the Q2 conference call:

Much better utilization, expanding costs and in specific regions of the small business, charges are improving upon far better and a lot quicker than we expected alongside with far better phrases and situations. We are securing for a longer period expression contracts and hunting to see much more perform with some of the Properly Intervention assets into 2025.

(…)

Not only have the uncertainties of 2022 turning out to be very clear, we also have potentially the ideal visibility in recent many years at this issue for what may perhaps transpire subsequent year in 2023.

(…)

We have identified as 2022 a changeover year for Helix. We entirely intend to changeover from a weak market place in ’22 to a substantial demand industry in ’23 and over and above.

In the Q2 presentation, Helix projected up to $127 million in EBITDA advancements in 2023 dependent on anticipations for very well intervention charges currently being up between 30% and 45% for the entire calendar year in comparison to fees at the beginning of 2022.

The enterprise also forecasted higher utilization and charges for the Robotics segment future 12 months.

Business Presentation

Personally, I am expecting Adjusted EBITDA of at minimum $225 million in 2023, additional than double the higher stop of the firm’s projection for this 12 months.

At this amount, Helix should really return to significant cost-free dollars move era future year.

With the organization trading at just 2.7x EV / Modified 2023 EBITDA even with existing anticipations for a multi-12 months recovery in the offshore oil and gasoline markets, Helix appears remarkably affordable.

Bottom Line

While 2022 will be practically nothing to create dwelling about for Helix Strength Remedies, the corporation initiatives sizeable enhancement heading into up coming calendar year with the likely to at least double Adjusted EBITDA from predicted 2022 concentrations.

Even just after the new acquisition of Alliance, Helix proceeds to have a reliable harmony sheet with minimal web credit card debt amounts and first rate liquidity which really should boost significantly over the following pair of quarters.

With the enterprise investing at just 2.7x projected EV / Adjusted 2023 EBITDA, Helix seems extremely cheap.

That stated, with shares up by nearly 40% from

modern lows, investors should take into consideration ready for a setback just before opening a position.

Get extensive Helix Power Solutions to attain publicity to the predicted multi-calendar year restoration in offshore oil and fuel products and services. Assuming no main promote-off in oil price ranges, I would count on shares to double from present degrees heading into up coming calendar year.

[ad_2]

Supply website link