Our joiner came by recently and the news was not good.

There were being a handful of issues influencing when he could appear by to renovate the toilet but that was not the issue.

The actual fear was the climbing price of setting up elements.

Sucking his teeth, he described a current journey to the builders’ merchant where by he identified that the price tag of a mere handful of joinery experienced skyrocketed to in excess of £50, let alone the cost of drywall which appears to be to have tripled.

A several days later on I spoke to a several farmers who ended up nervous about harvesting their crops and running the livestock. Now that we are away from the European Union, plus the complications of vacation in a world pandemic, the regular employees have been acquiring it difficult to get right here. Alternatively, the farmers have been trying to recruit locals. It has not labored out notably well, with hundreds not even bothering to exhibit up and a lot of of individuals that did have not stuck all-around.

Component of this is down to the furlough scheme. There are signals that a lot of workers are asking themselves why they should really indication up for challenging operate outside dealing with the features of an Aberdeenshire summer time if they really don’t have to. Variables also include the aspect opening up of hospitality – desire for chefs, bartenders, waiters has gone through the roof throughout the total of the British isles, sucking up any availability amid workers.

Shortages of resources and labour

The issue for the two the joiner and the farmer is lack – of both resources or labour. And any individual who is familiar the very first basic principle of economics – offer and demand from customers – can make a sensible guess that where by demand outstrips offer, price ranges go up.

This is resulting in problem for coverage makers. Or at minimum some of them. This 7 days the Bank of England said inflation will rise more than 3% this 12 months, which is bigger than anticipated. Consumer cost inflation jumped to 2.1% in May possibly and is climbing. The bank’s goal, set by the United kingdom authorities, is 2%.

The uptick is remaining pushed by the sheer pounds of desire – unleashed from lockdown with wads of dollars saved up, customers are on a mission to commit, devote, spend.

Nonetheless, this invest potential customers to lack as perfectly as mounting costs and wages. This week the bank’s Financial Policy Committee refrained from making any changes these as notching up the historically very low curiosity charge nor did they shut the faucets on the flood of economic stimulus that has propped up the Uk economic system given that the dim days of the banking crisis above a decade back.

Inflation chance dismissed?

Basically plan makers have dismissed the increase in inflation as a blip which will subside. The danger of spiraling inflation like that which hit the Uk in the 1970s is negligible, they believe that.

Let’s hope they are right. The be concerned is pandemic and the wholly unparalleled intervention of the Uk federal government to stave of economic collapse will most likely participate in havoc with forecasts. And whilst economists are revered for their insight and capability to grasp complicated modelling, heritage has proven they are rarely proved proper.

Prices for elements in my rest room are “skyrocketing”

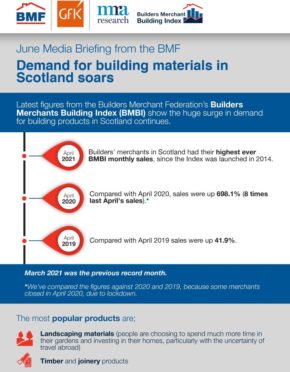

But back to my rest room. Latest figures out this 7 days verify my joiner is correct to be astounded. The Builders’ Merchant Federation claimed a big surge in desire for resources in Scotland in April – eight situations better than that in the exact same month previous yr. As a result, charges for resources are “skyrocketing”, prompting the Federation of Master Builders to call for serene to assure smaller businesses do not get elbowed aside by more substantial types with larger purchasing electric power.

I havent’ received the last invoice nonetheless but I’ll be worried to seem.